Steps To Filing Bankruptcy In Ky

Kentucky bankruptcy court locations and websites.

Steps to filing bankruptcy in ky. If you live in kentucky and want to file for chapter 7 or chapter 13 bankruptcy you ll need to complete several steps. To file for bankruptcy in kentucky you can either file for chapter 7 which will liquidate your assets and discharge most of your debts or chapter 13 which will establish a repayment plan and allow you to keep your assets. Find out about both in bankruptcy filing fees and costs. File those forms in a kentucky bankruptcy court and.

Bankruptcy is primarily governed under federal law specifically title 11 of the u s. Keep in mind that in order to file for chapter 7 your monthly income will need to be below the state median. Kentucky bankruptcy process how to file bankruptcy in kentucky 2005 bankruptcy act credit counseling the 2005 bankruptcy act requires all individual debtors who file bankruptcy on or after october 17 2005 to undergo credit counseling within six months before filing for bankruptcy relief and to complete a financial management instructional. Code most individuals who file bankruptcy do so under chapter 7 which is a liquidation bankruptcy rather than filing under chapter 13 for a reorganization.

Though bankruptcies are heard in federal bankruptcy court there are still some state laws that apply. Many people benefit from retaining counsel. For instance you must. The course usually takes less than two hours and as long as you are comfortable doing so you can complete it online through one of the approved providers.

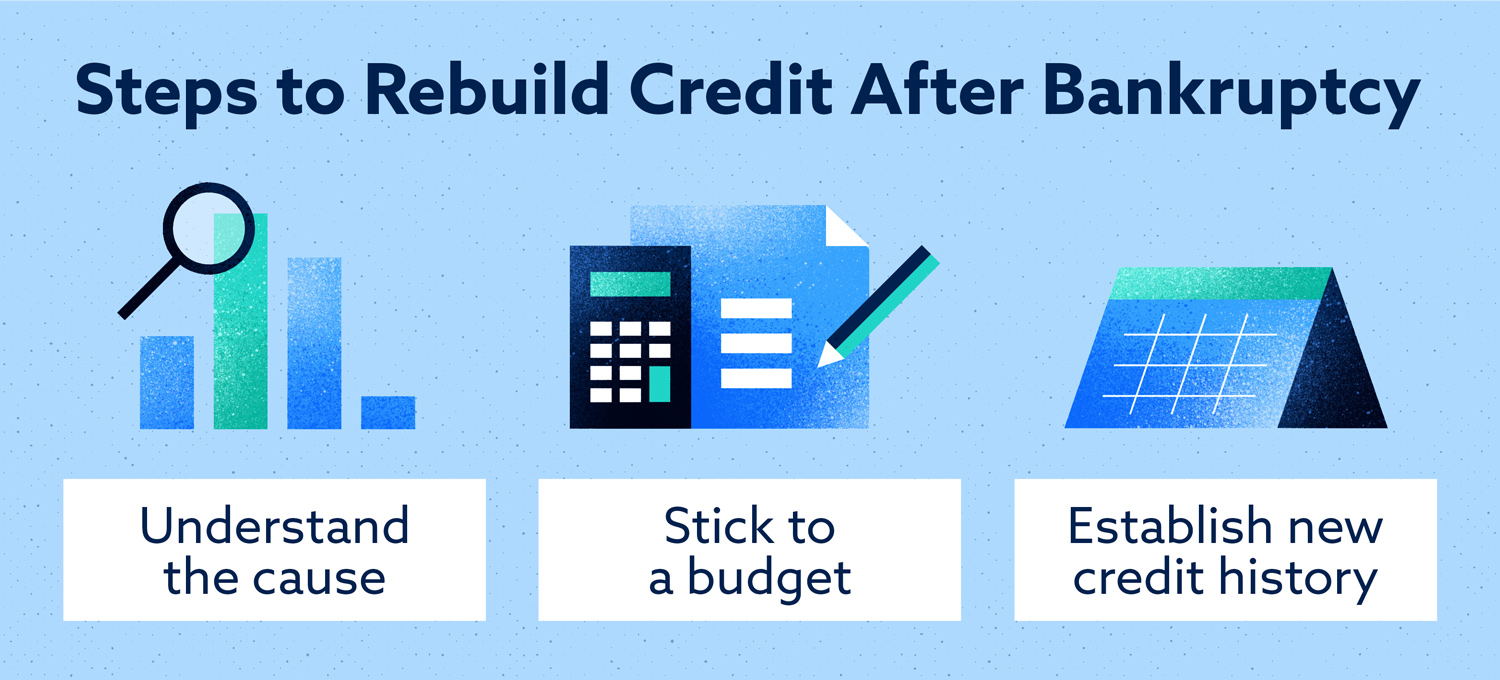

Complete the bankruptcy petition and other required forms. The cost to hire a lawyer varies depending on the area. Participate in credit counseling before you file. Filing chapter 7 bankruptcy in kentucky is a serious step and congress says you have to take credit counseling before you can actually make your way down to the courthouse to take this step.