Steps To Filing Bankruptcy Chapter 7

Filing chapter 7 bankruptcy in minnesota starts with a phone call to set you up with a totally free confidential debt consultation at one of our four convenient metro locations.

Steps to filing bankruptcy chapter 7. Find out how you qualify for chapter 7 debt relief what you should do before you file how debts are classified what will happen to your property and more. Chapter 13 to chapter 7. You will have to provide a full disclosure of your income assets and debts for the court to evaluate before you can file for chapter 7. The bankruptcy trustee appointed to your case sells your property to pay off your creditors and ends with a discharge of qualifying debt such as credit card balances medical debt and personal loans.

Once you complete your counseling you can begin your paperwork which includes a schedule of assets and liabilities a list of current income and expenditures and a list of all debts. Your free phone call. Upsolve walks you through the steps on how to file for chapter 7 bankruptcy and get your fresh start in 10 steps. You ll find us in minneapolis st paul blaine and brooklyn park.

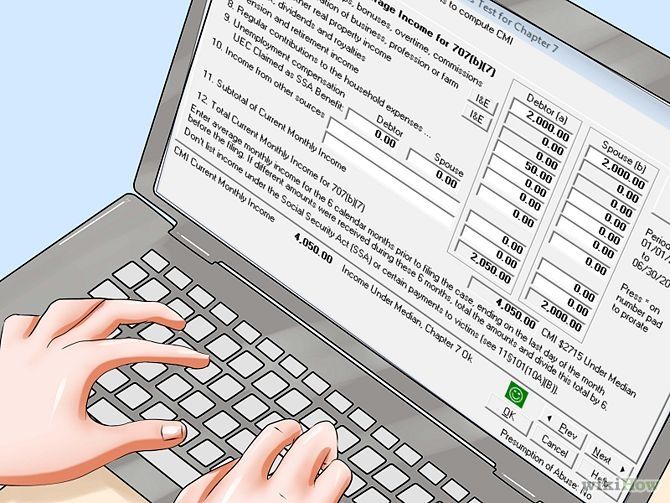

This requirement was added when the bankruptcy laws were overhauled in 2005. You will need to file your completed means test forms to the court along with your petition. Some debts such as child support obligations most student loan balances and recent tax debt aren t dischargeable wiped out in chapter 7 bankruptcy. If you previously received a discharge in a chapter 13 bankruptcy you must wait six years from the date that petition was filed to receive a discharge in a chapter 7 bankruptcy.

You must receive credit counseling during the six month period prior to filing for chapter 7 bankruptcy. Get your basic chapter 7 bankruptcy questions answered. Filing for chapter 13 after a chapter 7 is commonly referred to as a chapter 20 bankruptcy. This is an income based method of assessing whether you qualify for chapter 7 bankruptcy or if you should pursue other forms of debt relief such as filing for chapter 13.

Our knowledgeable experienced and understanding staff will treat you with the respect that you deserve. The law establishes limits on wealth income and property for chapter 7 bankruptcy. Most chapter 7 bankruptcy cases take about four months to complete. Chapter 7 bankruptcy is the most popular form of bankruptcy relief for individuals.

Chapter 7 bankruptcy is an important debt relief tool for americans in severe financial distress from losing a job getting injured or getting divorced. To file for chapter 7 bankruptcy start by completing the mandatory credit counseling which costs 20 50. Here are the general steps you will have to take to file for chapter 7 bankruptcy yourself. The basic idea behind chapter 7 is this.

Take the means test.