Steps To Filing Bankruptcy Chapter 13

The trustee pays your creditors each month.

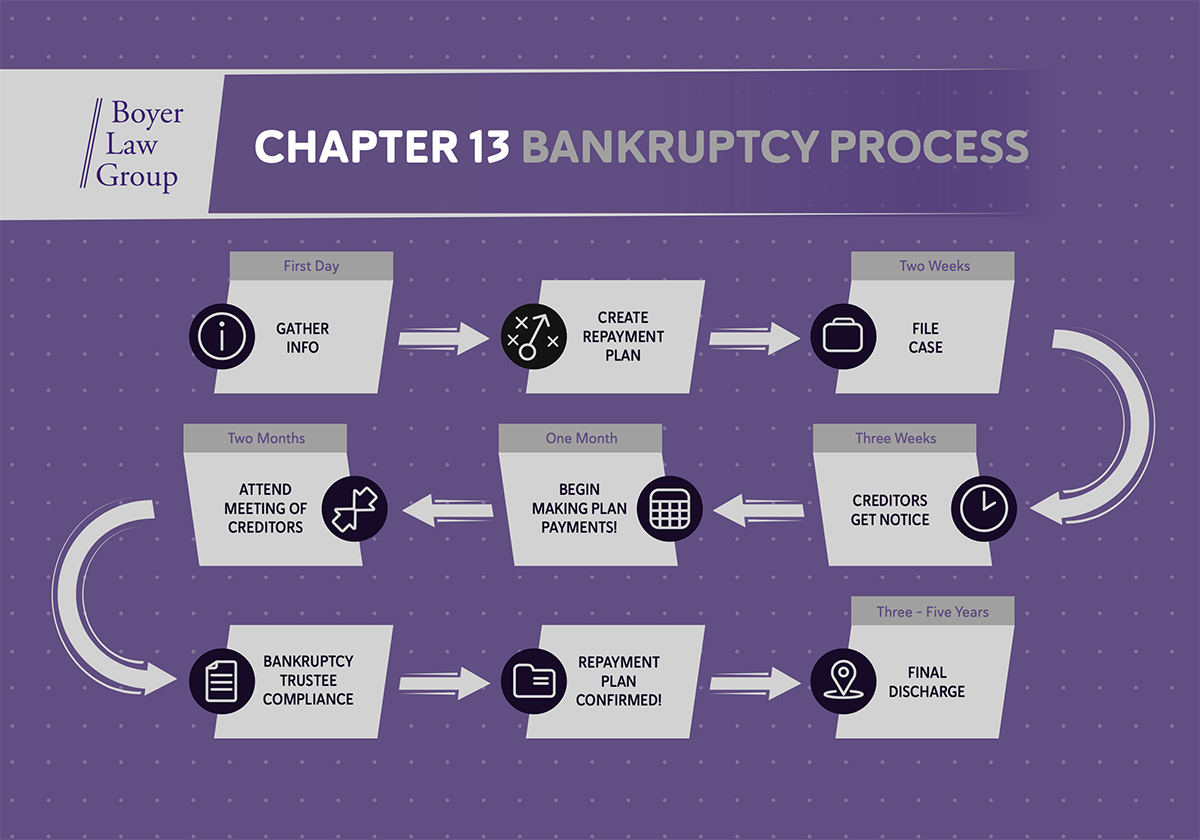

Steps to filing bankruptcy chapter 13. Most chapter 13 filers hire an attorney to help navigate the chapter 13 process and most bankruptcy courts strongly advise doing so. The automatic stay takes effect. If you file a chapter 7 and have no assets of large value it is called a no asset case and the courts will not sell your property. The top priority debts are those unaffected by bankruptcy such as child support.

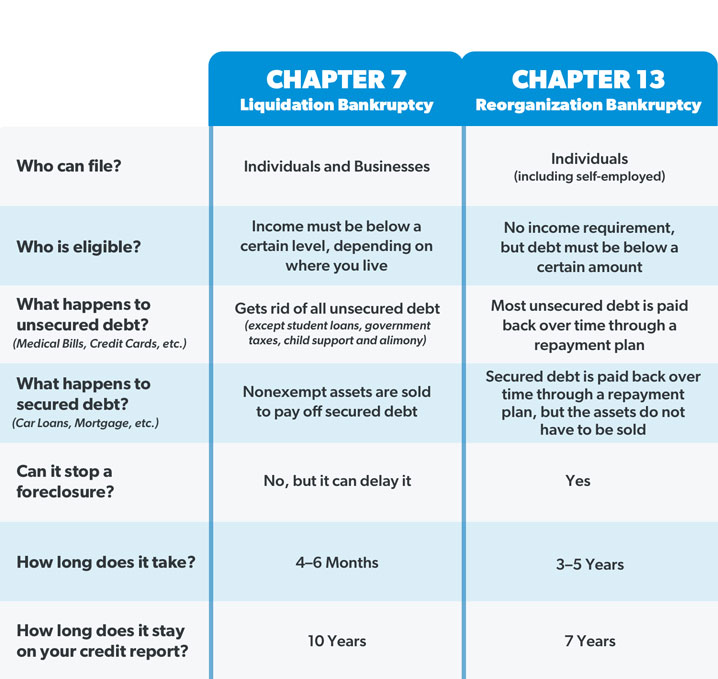

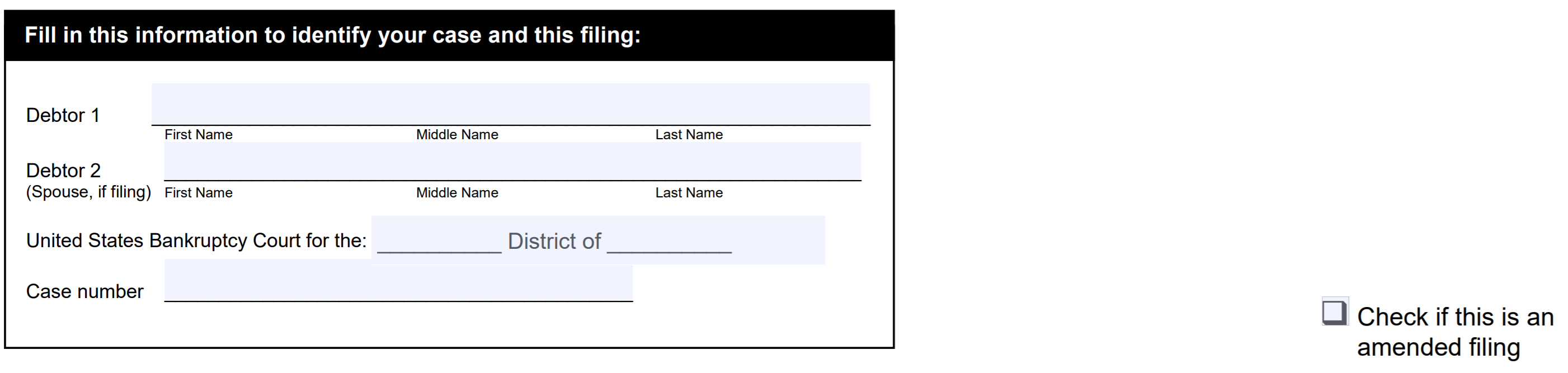

Chapter 13 is an alternative to chapter 7 and is designed for people with a regular income who want to pay off their debts but need a certain amount of time to do so. It bars most creditors from taking any actions to collect what you owe. Determine if chapter 13 is the right bankruptcy option. A chapter 13 case begins by filing a petition with the bankruptcy court serving the area where the debtor has a domicile or residence.

Make sure chapter 13 is the right choice. Before you file your chapter 13 bankruptcy case. 2 a schedule of current income and expenditures. You file for chapter 13 bankruptcy.

Both have unique features that help filers solve particular problems. 10 steps to file bankruptcy chapter 13. Also anyone seeking bankruptcy protection must undergo credit counseling from an approved agency within 180 days of filing a petition. 3 a schedule of executory contracts and.

Chapter 13 petitioners must stipulate that they haven t had a bankruptcy petition dismissed in the 180 days before filing due to their unwillingness to appear in court. For instance in a chapter 13 bankruptcy you can catch up on missed mortgage or auto loan payments and prevent a home foreclosure or car repossession. When you have completely filled out and reviewed your bankruptcy forms you ll need to print them out sign the signature pages and bring them to court. You complete your official bankruptcy paperwork and take a pre filing credit counseling course.

1 schedules of assets and liabilities. 10 steps to file bankruptcy chapter 13. Home bankruptcy chapter 13 10 steps to file bankruptcy chapter 13. Most individuals choose between chapter 7 and chapter 13 bankruptcy.

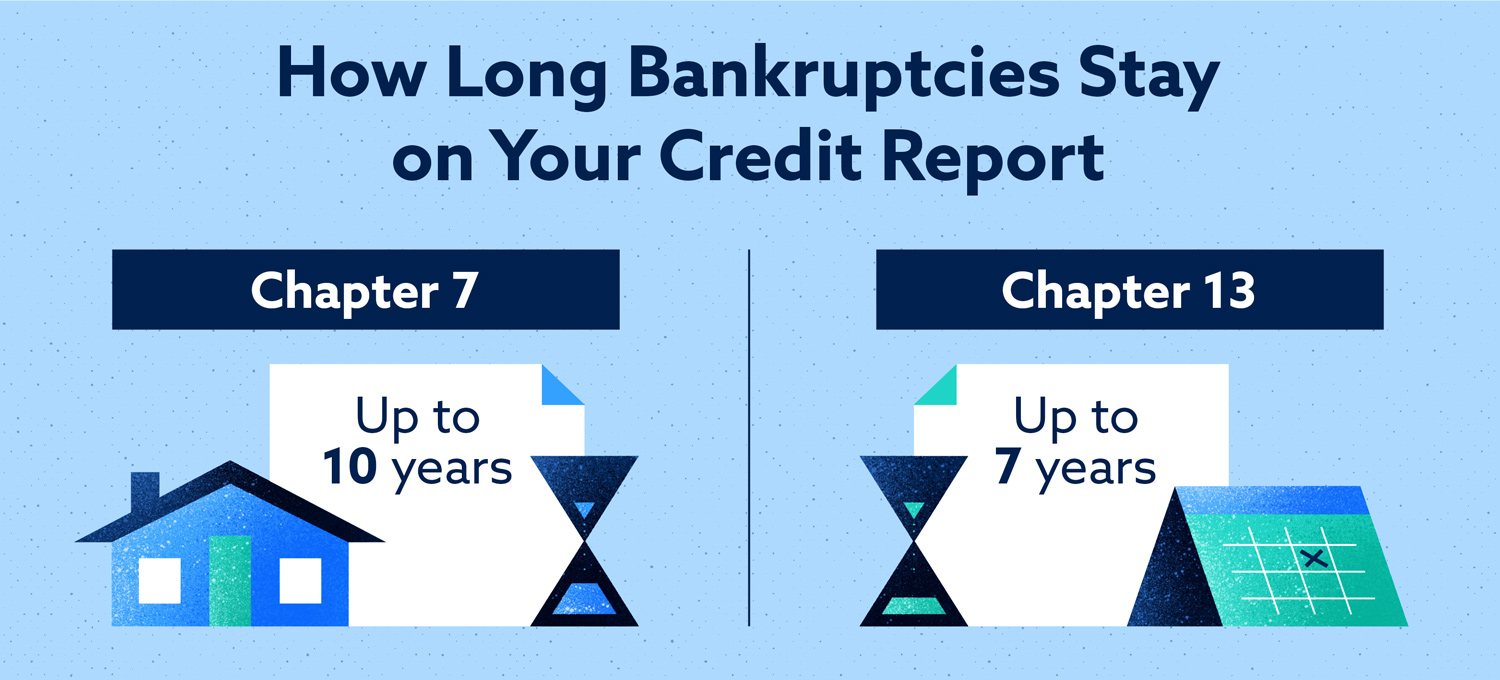

Unless the court orders otherwise the debtor must also file with the court. Even if you re represented by counsel it s a good idea to understand what a chapter 13 case will involve before you embark on the process. Don t forget to include your credit counseling certificate along with your printed bankruptcy forms. In chapter 13 you spend three to five years paying all your disposable monthly income to a bankruptcy trustee supervising your case.

Next come debts secured by collateral such as a mortgage. In chapter 13 debtors repay their creditors either in full or in part over a period of up to three years.