Steps To Become A Tax Preparer In California

However how long it takes to become a seasoned tax preparer is perhaps the more correct question to ask as the ability to make money and build a career is dependent upon a certain amount of experience and skill.

Steps to become a tax preparer in california. How to become a registered tax preparer to become a ctec registered tax preparer you must. In the time it takes to apply for and receive a ptin and an efin. Therefore california tax preparers must possess a federal preparer tax identification number ptin. Camarines sur philippines i have one hectar.

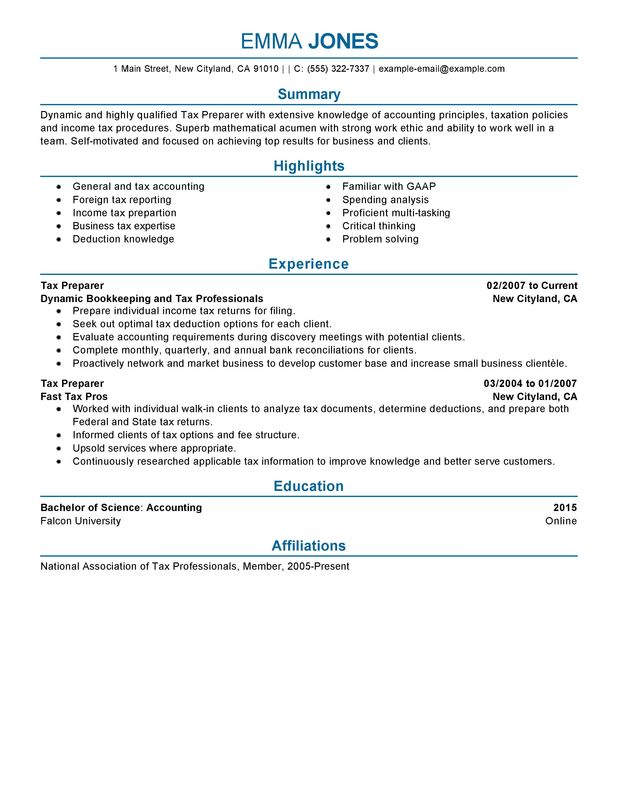

The simplest answer to this is. The california franchise tax board and the california tax education council regulate tax preparers and issue annual certificates to allow them to legally prepare tax returns. Steps to become a ctec registered tax preparer crtp in california ctec application process for new preparers step 1. Steps to becoming an enrolled agent.

Take a 60 hour qualifying education course from a ctec approved provider within the past 18 months purchase a 5 000 tax preparer. Complete online application for new preparers at ctec website. Steps to become a ctec registered tax preparer crtp if you are seeking to register for the first time as a ctec registered tax preparer ctrp there are several steps you will need to take. How to become a tax preparer in california 3 comments 12 966 views as the name implies the main responsibility of tax preparer in california is to prepare and to file income tax returns.

If you work for a ctec registered preparer but have no. How to become a tax preparer in california. Visit prometric s special enrollment examination see web page to schedule your test appointments review the see candidate information bulletin pdf sample test questions and other test preparation resources. Approved education course providers are listed on the ctec website or available upon request from ctec.

Complete 60 hours of qualifying tax education. Obtain a preparer tax identification number ptin. Anyone who prepares tax returns for a fee in california is required by law to register as a tax preparer with the california tax education council tax preparers who are california certified public accountants cpas enrolled agents eas attorneys who are members of the state bar of california and certain specified banking or trust officials are exempt from the requirement.