Step Up Cds Automatically Increase

:max_bytes(150000):strip_icc()/cd-basics-how-cds-work-315245-v4-5ba5068946e0fb002558ccde.png)

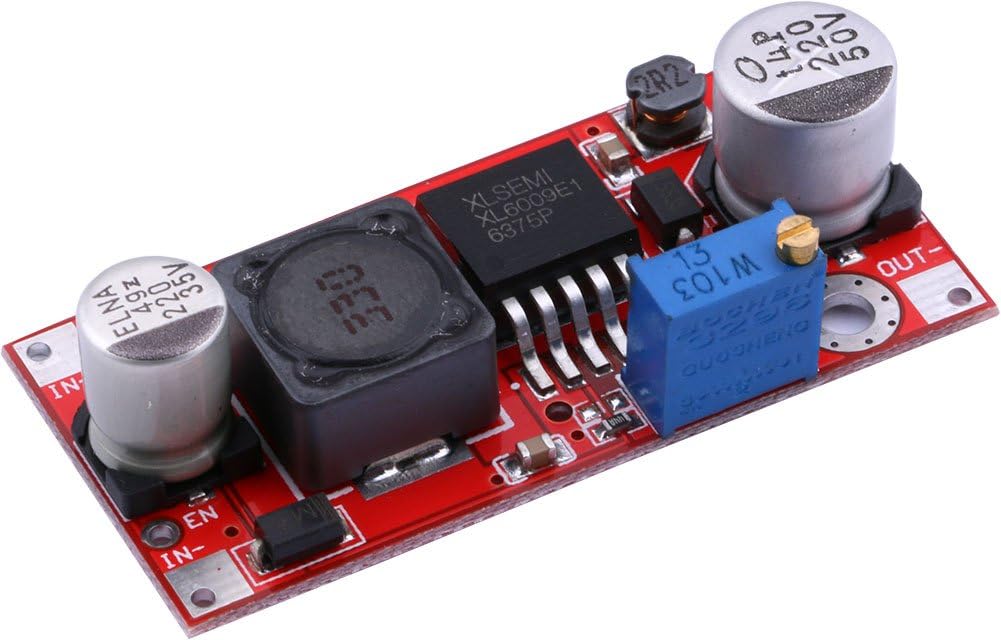

Bank also offers step up or trade up cds.

Step up cds automatically increase. Another recent example is the three year step up cd advertised at a different american bank with apys of 1 75 for the first year 2 75 for the second and 4 for the third. Step up and step down cds increase automatically to a predetermined interest rate so investors do not have to do any research. A bump up cd allows you to request a. On top of its standard cds u s.

Bank branch to redeem before the maturity date. Since the increase is automatic investors benefit from the rate increase faster than they would with other cd options. Option to trade up one time only during the initial term requires you to visit a u s. Defining step up cds.

Time until step increase. It may take up to ten days for rate change to become effective. Step up your savings with an interest rate increase every seven months. Cd is automatically renewed for the same term.

But in reality they re two different products. Step up cds are sometimes referred to as bump up cds. Some banks or credit unions refer to these as step up rate cds. With step up cds predefined rate increases happen automatically at certain intervals.

The rate is determined based on the published rate for the cd excluding. Every seven months the interest rate increases during this cd s 28 month term. Compare to a bump up cd. The table below shows the period of qualified service needed to advance to the next step.

Banks and credit unions don t always use the same terminology so for the purpose of this article we ll use step up cds to refer to a cd with an interest rate that rises automatically at specific points in time. Rate change option is based on the published rate for the closest standard term that is equal to or less than the remaining term of the original cd. With a bump up cd you have the potential to earn a higher rate but you need to request the rate increase which might not ever be available. Step up cds automatically raise your interest rate at regular intervals.

Disadvantages of step up and step down certificate of deposit cd. General schedule and law enforcement officer schedule use a 10 step system and have the same length of time between step increases. The blended rate. Investors lose money if rates.

The step up cd gives you an automatic interest rate increase every seven months during the cd s 28 month term.

/investment-3999136_1920-7e692563c3ea473d968c27d90ba7c5c6.jpg)

:max_bytes(150000):strip_icc()/Best6-monthCDs-89eb38cbf5094cd4aab4b4559d76c083.jpg)